By Gerry Klump, Enrolled Agent and Gilda’s Club volunteer

So, the holidays are over and you just got your tax forms in the mail. Don’t forget when filing for 2021 you can deduct up do $300 as an individual and $600 as a couple even if you don’t itemize; and charitable deductions can still be taken on the state returns.

Now is also the time to plan for 2022. Donating appreciated property held more than 12 months is a great idea if you itemize. For those 70 ½ or older there is an even better tax beneficial way to give. Enter the Qualified Charitable Distribution (QCD).

A QCD is a direct transfer of funds from your IRA custodian, payable to a qualified charity up to $100,000 per year. QCDs can be counted toward satisfying your required minimum distributions (RMDs) for the year, as long as certain rules are met.

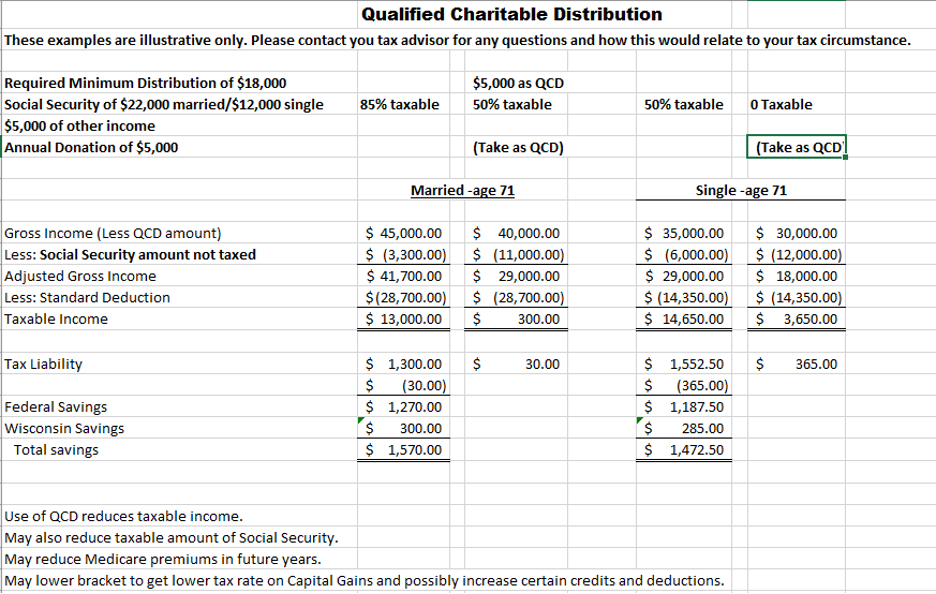

In addition to the benefits of giving to charity, a QCD excludes the amount donated from taxable income, which is unlike regular withdrawals from an IRA. Keeping your taxable income lower may increase certain tax credits and deductions, reduce the taxable amount of Social Security, lower your tax rate on capital gains and reduce future Medicare premiums.

Also, QCDs don’t require that you itemize, which due to the recent tax law changes, means you may decide to take advantage of the higher standard deduction, but still use a QCD for charitable giving.

Consult a tax advisor to determine if making a QCD is appropriate for your situation and if your IRA and charity qualifies for QCDs.